Lecture 7: Capital Asset Pricing Model (CAPM) – Part 1

1. Introduction to CAPM and Its Importance

The Capital Asset Pricing Model (CAPM) is a foundational concept in finance that explains the relationship between systematic risk and expected return for assets, particularly stocks. It provides a framework for pricing risky securities and generating expected returns for investments.

2. Discussion of Markowitz’s Assumptions Underlying CAPM

The CAPM builds on the foundational work of Harry Markowitz’s Modern Portfolio Theory (MPT) , which introduced the concepts of diversification, risk-return trade-offs, and efficient portfolios. The following assumptions from Markowitz are critical to understanding CAPM:

-

Investors are Rational and Risk-Averse :

Investors aim to maximize their expected utility by balancing risk and return. They prefer higher returns for a given level of risk and lower risk for a given level of return. -

Markets are Efficient :

All investors have access to the same information, and asset prices reflect all available information. This ensures no investor has an unfair advantage. -

Homogeneous Expectations :

Investors share the same expectations regarding asset returns, risks, and correlations. This leads to a consensus on the efficient frontier. -

Assets are Infinitely Divisible :

Investors can buy or sell any fraction of an asset, allowing for precise portfolio construction. -

No Taxes or Transaction Costs :

These frictions are ignored to simplify the model, ensuring that asset allocation decisions are based purely on risk and return. -

Single Investment Period :

The model assumes a single holding period, simplifying the analysis of returns and risks.

3. Assumption of Risk-Free Borrowing and Lending

One of the key assumptions of CAPM is the availability of risk-free borrowing and lending at the same risk-free rate (). This assumption plays a crucial role in the derivation of the Capital Market Line (CML) and the overall CAPM framework.

-

Risk-Free Asset Characteristics :

- A risk-free asset has zero variance () and is uncorrelated with risky assets ().

- Examples include government treasury bills or bonds issued by stable governments.

-

Implications of Risk-Free Borrowing and Lending :

-

Creation of Leveraged Portfolios :

Investors can borrow at the risk-free rate to invest more in the market portfolio, increasing their exposure to market risk and potential returns.

Example: If an investor borrows 50% of their capital at and invests 150% in the market portfolio, the portfolio's risk and return will increase proportionally. -

Creation of Conservative Portfolios :

Investors can lend at the risk-free rate by allocating a portion of their capital to the risk-free asset, reducing overall portfolio risk.

Example: If an investor allocates 30% to the risk-free asset and 70% to the market portfolio, the portfolio's risk and return will decrease. -

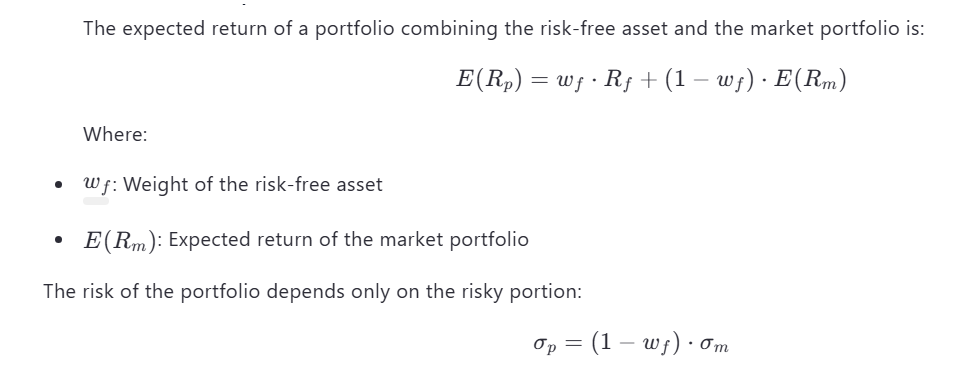

Linear Relationship (CML) :

The inclusion of a risk-free asset transforms the efficient frontier into a straight line (the Capital Market Line), representing all possible combinations of the risk-free asset and the market portfolio.

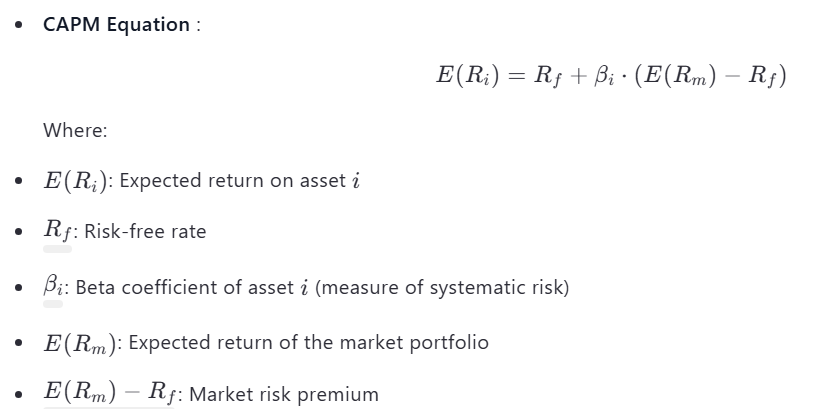

Mathematical Representation :

-

4. Practical Implications of the Risk-Free Rate Assumption

-

Real-World Challenges :

While the assumption of a uniform risk-free rate simplifies the model, real-world conditions may differ:- Risk-free rates vary across countries and time periods.

- Borrowing rates for individual investors are often higher than the risk-free rate due to credit risk.

-

Impact on CAPM :

Despite these limitations, the risk-free rate assumption remains a useful theoretical construct for understanding the relationship between risk and return. It provides a baseline for comparing risky investments and constructing optimal portfolios.

Key Takeaways

- CAPM Overview : CAPM links systematic risk (beta) to expected returns, helping investors price assets and assess their risk-adjusted performance.

- Markowitz’s Assumptions : CAPM relies on assumptions such as rationality, efficient markets, homogeneous expectations, and the absence of taxes or transaction costs.

- Risk-Free Borrowing and Lending : The availability of a risk-free asset allows investors to create leveraged or conservative portfolios, transforming the efficient frontier into the Capital Market Line (CML).

- Practical Application : While the assumptions of CAPM may not perfectly reflect real-world conditions, the model remains a cornerstone of modern finance for portfolio optimization and asset pricing.