Lecture 11: Evaluating / Measuring the Performance of Financial Portfolios

1. Concept of Portfolio Performance and Its Importance

Portfolio performance measurement is a critical aspect of investment management. It helps investors assess how well their portfolios are achieving their risk-return objectives.

-

Definition :

Portfolio performance refers to the ability of a portfolio to generate returns relative to its level of risk. -

Importance :

- Provides insights into whether the portfolio is meeting its objectives.

- Helps in comparing the performance of different portfolios or investment strategies.

- Guides decision-making regarding portfolio adjustments or manager evaluations.

2. Benchmarking (Relative Performance)

Benchmarking involves comparing a portfolio's performance to a relevant market index or peer group. This provides context for evaluating whether the portfolio has underperformed or outperformed.

-

Types of Benchmarks :

- Market Indices : S&P 500, FTSE 100, etc., depending on the asset class.

- Custom Benchmarks : Tailored indices that reflect the portfolio's specific strategy or risk profile.

-

Key Considerations :

- The benchmark should be appropriate for the portfolio's asset allocation and investment style.

- A portfolio that consistently beats its benchmark is considered successful.

3. Models for Measuring Performance

Several models are used to evaluate portfolio performance by considering both returns and risks.

1. Sharpe Ratio

Measures the risk-adjusted return of a portfolio. It evaluates how much excess return is generated per unit of total risk.

-

Interpretation :

- Higher Sharpe Ratios indicate better risk-adjusted performance.

- Useful for portfolios with diversified risks.

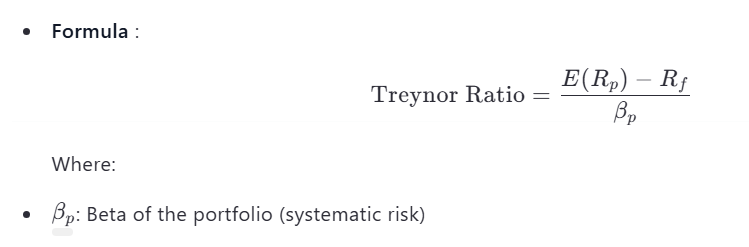

2. Treynor Ratio

Focuses on the excess return per unit of systematic risk (beta).

-

Interpretation :

- Suitable for evaluating portfolios that are part of a larger diversified portfolio.

- Emphasizes systematic risk rather than total risk.

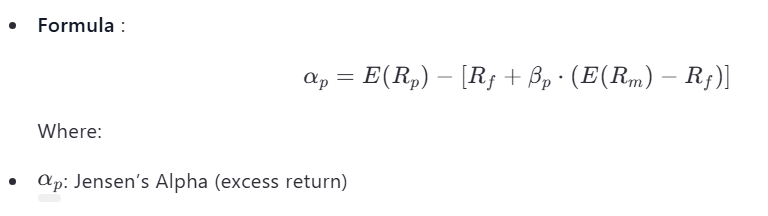

3. Jensen’s Alpha

Measures the excess return of a portfolio compared to the return predicted by the Capital Asset Pricing Model (CAPM). It indicates the value added (or lost) by active management.

-

Interpretation :

- Positive alpha indicates outperformance; negative alpha indicates underperformance.

- Reflects the skill of the portfolio manager in generating abnormal returns.

4. Modern Derived Models for Performance Measurement

In addition to traditional models, newer approaches have been developed to address limitations and incorporate additional factors.

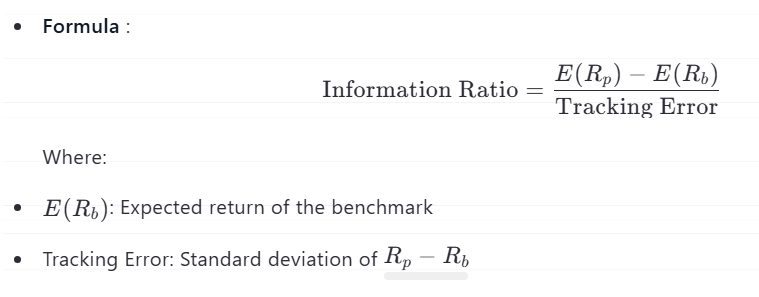

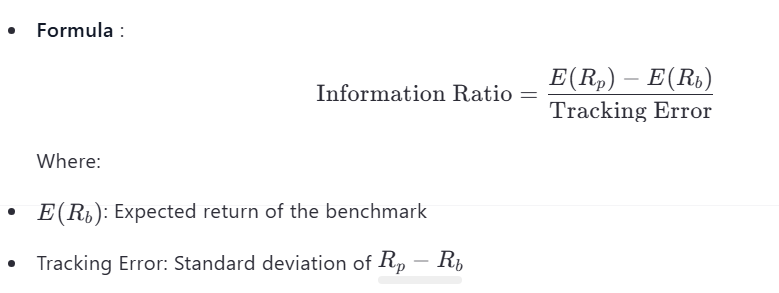

1. Information Ratio

Measures the excess return of a portfolio relative to a benchmark, adjusted for tracking error (the volatility of the difference between portfolio and benchmark returns).

-

Interpretation :

- Higher values indicate better risk-adjusted performance relative to the benchmark.

2. Sortino Ratio

Similar to the Sharpe Ratio but focuses only on downside risk (volatility of negative returns).

-

Interpretation :

- More relevant for investors concerned with minimizing losses rather than total volatility.

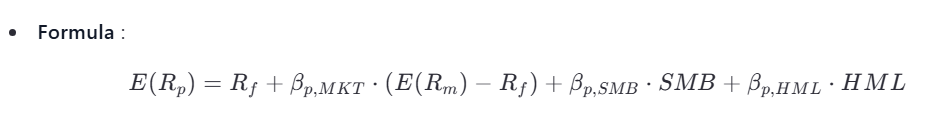

3. Fama-French Three-Factor Model

Extends the CAPM by incorporating additional factors (size, value) to explain portfolio returns.

-

Interpretation :

- Provides a more comprehensive evaluation of portfolio performance by accounting for multiple sources of risk.

5. Practical Applications

-

Equity Portfolios :

- Sharpe and Treynor Ratios are commonly used to evaluate diversified equity portfolios.

- Jensen’s Alpha helps assess the skill of active managers.

-

Fixed-Income Portfolios :

- Information Ratio is useful for bond portfolios benchmarked against indices like the Bloomberg Barclays Aggregate Bond Index.

- Sortino Ratio is valuable for managing downside risk in volatile fixed-income markets.

-

Hedge Funds and Alternative Investments :

- Multi-factor models like Fama-French are often applied to evaluate complex strategies.

6. Key Takeaways

- Performance Metrics : Tools like Sharpe, Treynor, and Jensen’s Alpha provide quantitative measures of portfolio performance.

- Benchmarking : Comparing portfolios to benchmarks ensures relative performance is evaluated accurately.

- Modern Models : Advanced metrics like the Information Ratio, Sortino Ratio, and multi-factor models offer deeper insights into portfolio behavior.

- Choosing the Right Model : The choice of performance measure depends on the portfolio's characteristics, investment objectives, and risk tolerance.